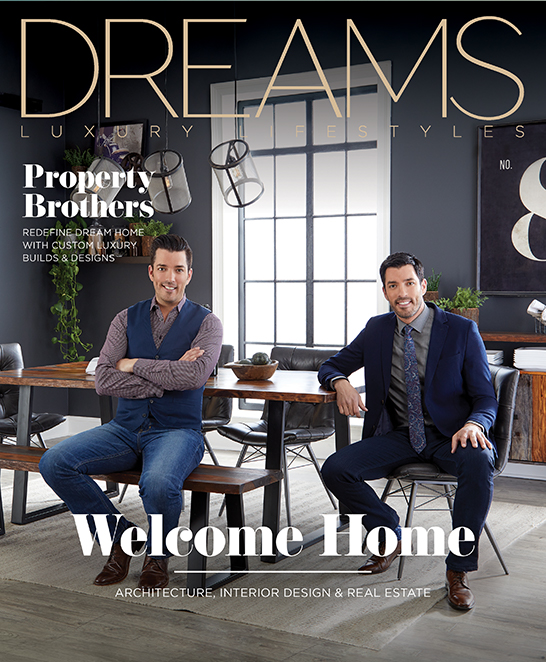

Helping Business Owners Make Sound Financial Decisions Drives Adam Torres

Interviewed By Ty Fischer

The readers of DREAMS care about their money. Whether it’s purchasing a home, auto or investment, they rely on the advice of trusted financial industry leaders. Adam Torres is the CEO and visionary force behind Century City Wealth Management LLC, a firm dedicated to the needs of business owners, entrepreneurs and executives. His financial advice has been featured in major financial publications such as Forbes, Investors Daily, and TheStreet. We recently sat down with him to learn about what drives him, the current market situation and his best advice for high-net worth individuals.

Q: What services do you provide and to who?

AT: I specialize in serving the retirement planning needs of business owners, covering everything from investing to insuring. Early in my career I realized that business owners rarely receive the customized financial planning they require. When you write your own paycheck and your cash flows vary, traditional retirement planning can fall short.

Q: How did you get started in the financial industry? What have you done to build your business and brand into what it has become today?

AT: My start in the business was somewhat unique. I started working in my first shop when I was 16 years old. I went to high school 2-3 hours a day, then went off to the brokerage firm, clocking out at 5:00pm. The first thing I often coach young advisors on is picking a niche to serve. Something that interests them. My father was a small business owner and I saw the struggles he had many times due to lack of financial knowledge. When you are busy running your business, it can be hard to always see the bigger picture. Growth in my business and brand can be attributed to “staying in my lane” and serving the clients I know best.

Q: What are the personal and professional attributes that have helped you create success in your life and business?

AT: Success is a journey and not a destination. My career has been marked with reaching new plateaus and finding a way to break through the complacency trap. If there was one key attribute that serves me, I’d say it’s my ability to reinvent myself. For example, when my practice grew to a nice cushy size it would have been easy for me to kick back and enjoy the supposed “fruits of my labor.” Instead, I decided to take on publishing and have released multiple books on real estate and personal finance. Why would I do this? Well my goal is to spread good, sound financial knowledge to as many people as I can. Books are just a vehicle to help me accomplish my calling.

My career has been marked with reaching new plateaus and finding a way to break through the complacency trap. If there was one key attribute that serves me, I’d say it’s my ability to reinvent myself.

Q: Real estate and equity markets are booming right now; it seems new records are being set on a weekly basis. Where do you predict the markets will be one year from now? Do you expect any recessions or major pullbacks in the near future?

AT: It’s obvious that the stock market has entered a more volatile phase. It’s likely that pullbacks are on the horizon. It is possible that this could take place within the next year, but I wouldn’t go as far as to say we are facing any recessionary level events. Also, it’s too soon to declare the bull market is over even though we are seeing late-cycle tendencies. Overall, investors should be cautious when adding on more risk than their overall financial plan can tolerate.

Q: What advice would you give to a high-net worth individual right now regarding their finances or financial strategy in today’s landscape?

AT: Make sure your investments match your overall financial plan. Many investors make the mistake of going head first into a portfolio or investment without considering how this will affect their overall financial situation. That is equivalent to a business owner opening another location without knowing anything about how it will affect his current operation. It’d be ridiculous. In our current investment environment, mistakes may be more costly than usual. There is less room for error than prior years when the entire market was pretty much on an upward trajectory. Develop a sound plan and stick to it.

Q: How are you connected with and involved in giving back to the community?

AT: As Founding Vice President of the Century City Rotary Club giving back to the community is one of my core beliefs. Rotary is a global network of more than 1.2 million members worldwide. The Century City Rotary Club is committed to creating an emergency preparedness plan for our community. This is a big task involving representatives from the local police, fire department, and political organizations all the way up to homeland security. It’s a big task and will take the commitment of many individuals, but I’m confident that the end result will be a more secure and safe Century City.

Q: What is your long-term vision for your business?

AT: My business will continue to evolve alongside the needs of my clients. Multi-generational financial planning for business owners is where my business has organically become focused on. Overall, it’s an exciting time to be in the financial services industry. Fin Tech advancements are bringing so much to the investment landscape. What once took many hours to complete can now be done in a fraction of the time, which benefits both advisors and clients alike.

To learn more visit centurycitywealthmanagement.com.

YOU MAY ALSO LIKE

Lady of Our Time: The 5 Best Women’s Watches To Wear in 2019