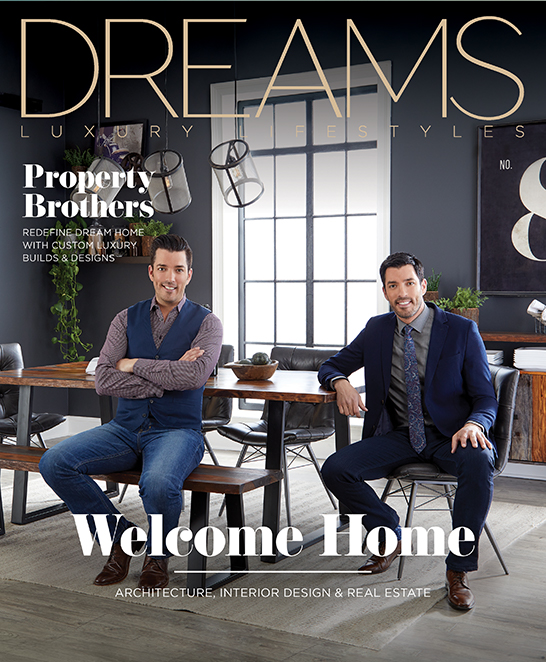

Pasadena Native Eszylfie Taylor Continues To Make An Impact

Interviewed By Ty Fischer | Photography By Charles Ng

Eszylfie Taylor is the President and Founder of Taylor Insurance and Financial Services located in Pasadena. We recently sat down with him to talk finance and investing, the challenges of being an entrepreneur and what the future holds for this accomplished owner of several businesses.

Q: How did you get started in business? Take us back to your upbringing, launching your business and the challenges you faced along the way.

ET: My father came from Ghana, West Africa, with nothing. My mom is from the South, and literally had to pick cotton as a child to make ends meet. My parents worked hard and laid a great foundation for me. I didn’t grow up with a silver spoon in my mouth. I graduated college with $100 in my checking account. I was given a good education, a roof over my head, food in my stomach, and tons of encouragement.

I’ve been able to take that foundation that my parents gave me and take it up to another level. September will mark the start of my 19th year in business. I was 22 years old when I started, and I wanted to be a millionaire by the time I was 25. I love this business because it gave me an opportunity to build something in my life based on my work ethic and my aptitude, not my age or my tenure.

Along the way there were many challenges. I like to tell people, “I challenge you to present someone that’s failed more than me.” That’s what I say and, consequently, that’s why I’m typically one of the most successful people in the room. I was just too stubborn to stay down. From 22, to now 40, I think I’ve failed every way you can fail in this business.

I’m full transparency and vulnerable with my clients. I’m not on a pedestal. I’m not better than anybody else. I’m not smarter than everybody else. I’ll put my drive and my work ethic against anyone, but it’s really just about being authentic.

Q: In what ways do you serve your clients?

ET: We have several businesses. At Taylor Insurance and Financial Services, which is a full-service financial services firm, we do everything from insurance – that would include life insurance, disability, long-term care – to the other side which are investments, so that’s stocks, bonds, mutual funds, annuities, alternative investments, etc., through SagePoint Financial, Inc. I’ve got about a dozen advisors here locally in the Pasadena office.

We take a macro perspective as it relates to our clients’ financial needs. So, it’s not looking at one singular area. It’s not just about insurance or just about investments or tax, we’re looking at everything. We really pride ourselves in being more planners, so we do a lot of retirement planning, tax planning, estate planning.

I also have my own brokerage general agency. We serve over 200 advisors throughout the country. And I’ve got the Taylor Method, an online sales and practice management tool where I coach and train financial advisors.

Q: Let’s talk money and markets. Real estate and equity markets are booming right now, but there’s also some uncertainty and volatility in the markets. Where do you predict the market is headed? What piece of advice would you give right now to a high net-worth individual regarding their finances in today’s landscape?

ET: One thing history has shown us is that any time the market has been trading at a high and corrected, it has recouped those losses and hit a new high 100% of the time. I think one of the biggest areas of concern right now is we’ve had about 10 years without a major correction. So, that’s cause for concern.

In my practice, I focus more on the risk mitigation and guarantees than I do pie-in-the-sky or huge returns. I always say, “it’s not a matter of how much money you make, it’s how much you keep.” It’s all about balance and diversification.

I want my clients to be at a particular threshold of comfort, or better, not high in the sky or in the gutter. I tell my clients all the time, “if you follow my philosophies, you may not achieve the highest of all highs, but you likely won’t experience the lowest of all lows.”

I tell my clients all the time, if you follow my philosophies, you may not achieve the highest of all highs, but you likely won’t experience the lowest of all lows.

Q: What is your long-term vision?

ET: I’m a big believer in the power of positive thought and manifestation. When people ask me how I’m doing, I tell them, “Every day is the best day of my life,” and I mean that, and I want to live it and I want to embody it. I believe that what you speak and what you think will come into existence. Not always in our timing, not always when we want it, but I think that it’s perfect timing.

I love J. Paul Getty’s wealth building principle: “I’d rather earn 1% from 100 people’s efforts than 100% from my own efforts.” I’m a big believer in collaboration and pulling people together and getting a little bit of a lot. And that’s how I’m able to give back and make such a big impact.

And so, how will this end? My newest thing is I feel like I should just go ahead and shoot to be a billionaire. I look at the positive impact that I’ll be able to have on the world and it drives me to accomplish this goal.

As for the future, I tell my three girls, “Whatever I leave, you have to do 10 times more. You have to grow it 10 times bigger than what I left you. And if you decide to have children, then your children have to make it 10 times bigger than you left them.”

At this point, my long-term vision and focus is the legacy that I leave.

Taylor Insurance and Financial Services is located at 1199 E Walnut Street in Pasadena, CA. To learn more visit taylorinsfin.com or contact (626) 356-7637.

YOU MAY ALSO LIKE